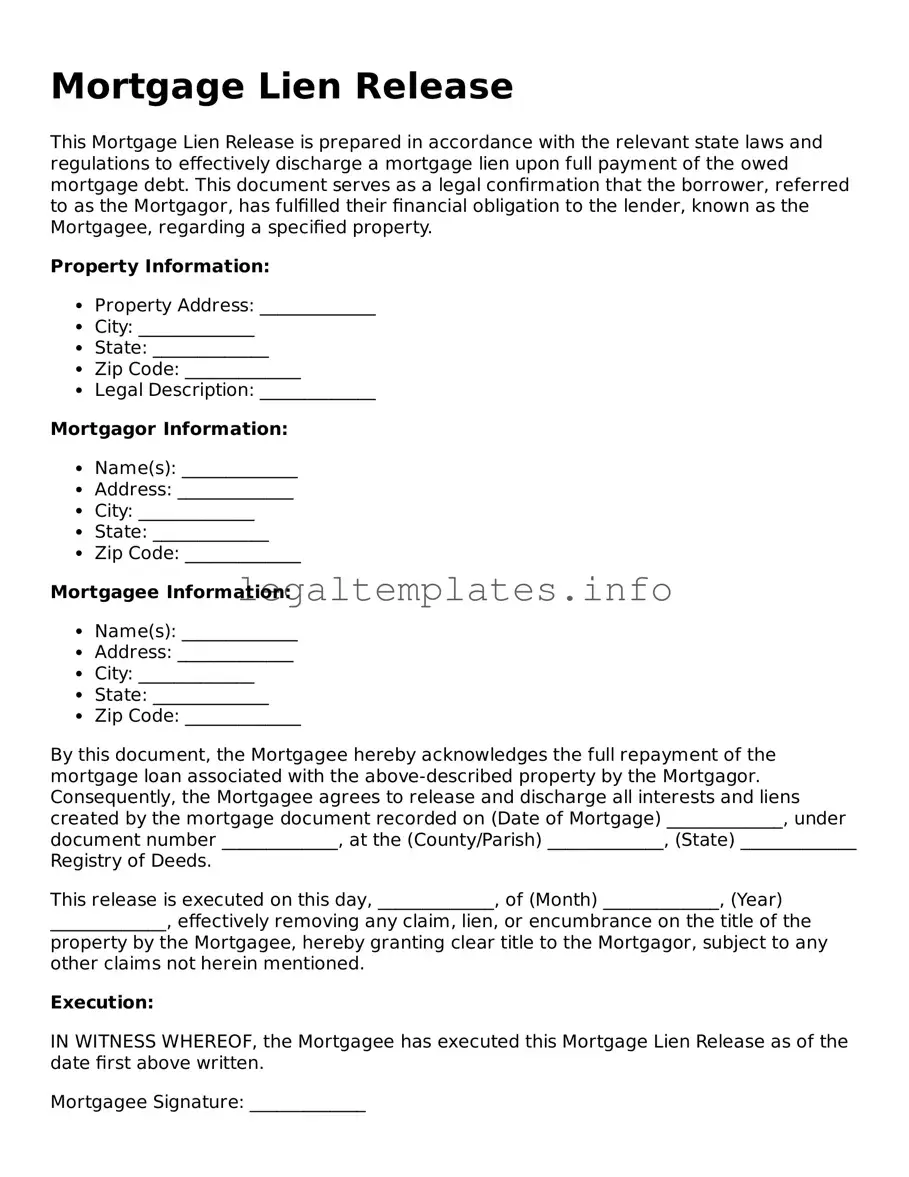

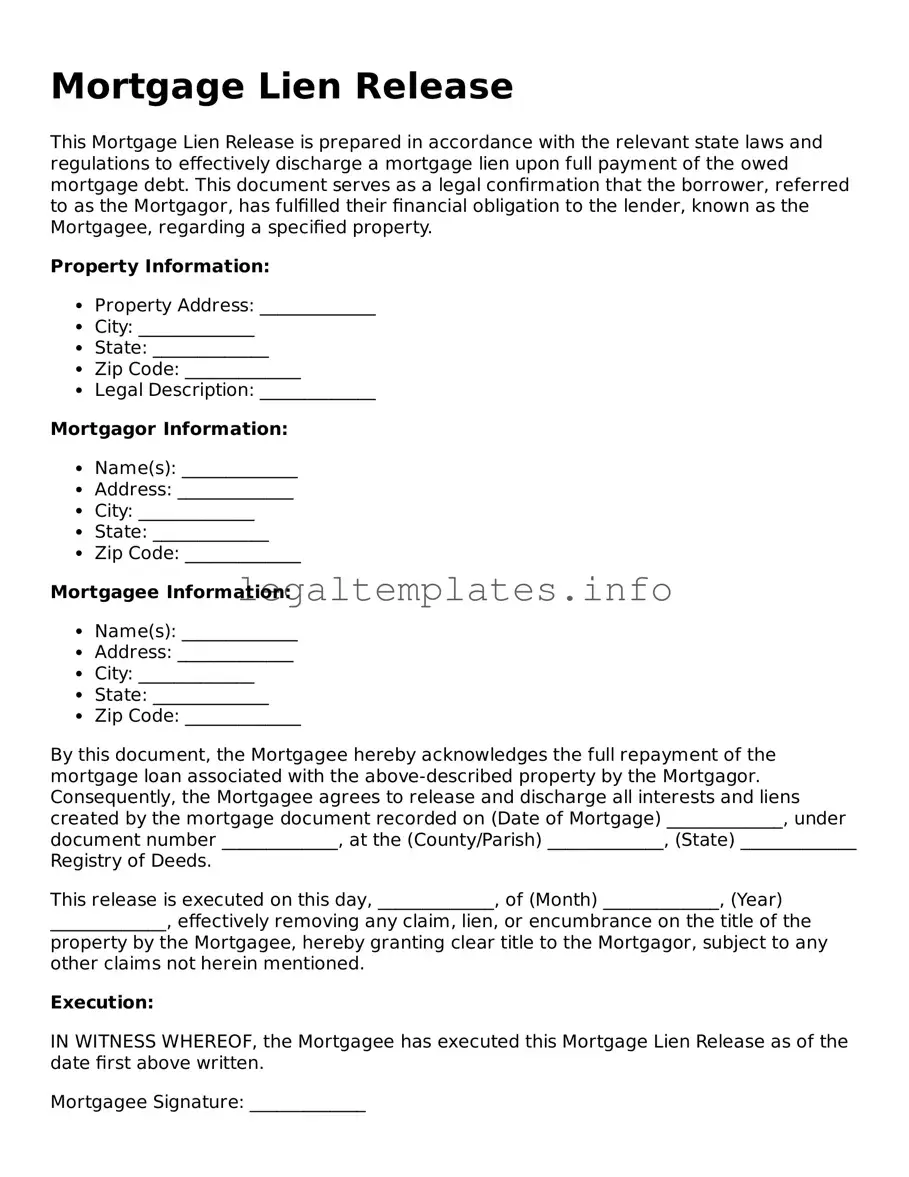

Fillable Mortgage Lien Release Document

A Mortgage Lien Release form is a crucial document that lenders use to formally acknowledge that a mortgage has been fully paid off and to remove the lien from the property's title. This form is the borrower's key to proving that they own their property free and clear of any financial obligations to the lender. If you're ready to clear your property's title and celebrate the full ownership of your home, click the button below to fill out your Mortgage Lien Release form.

Access Mortgage Lien Release Online

Fillable Mortgage Lien Release Document

Access Mortgage Lien Release Online

Access Mortgage Lien Release Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Mortgage Lien Release online.