What is a Release of Lien form used for in Texas?

A Release of Lien form in Texas is used to clear a property of a lien, confirming that the debt secured by the lien has been fully paid. It is an official acknowledgment by the holder of the note and lien (the lender) that the borrower has satisfied the terms of the loan, releasing the property from all claims associated with the lien.

Who needs to sign the Release of Lien form?

The holder of the note and lien, who is acknowledging the payment in full of the debt, must sign the Release of Lien form. If the lienholder is a corporation, the signature must be that of an authorized representative of the corporation. Additionally, the document must be acknowledged (notarized) by a Notary Public of the State of Texas.

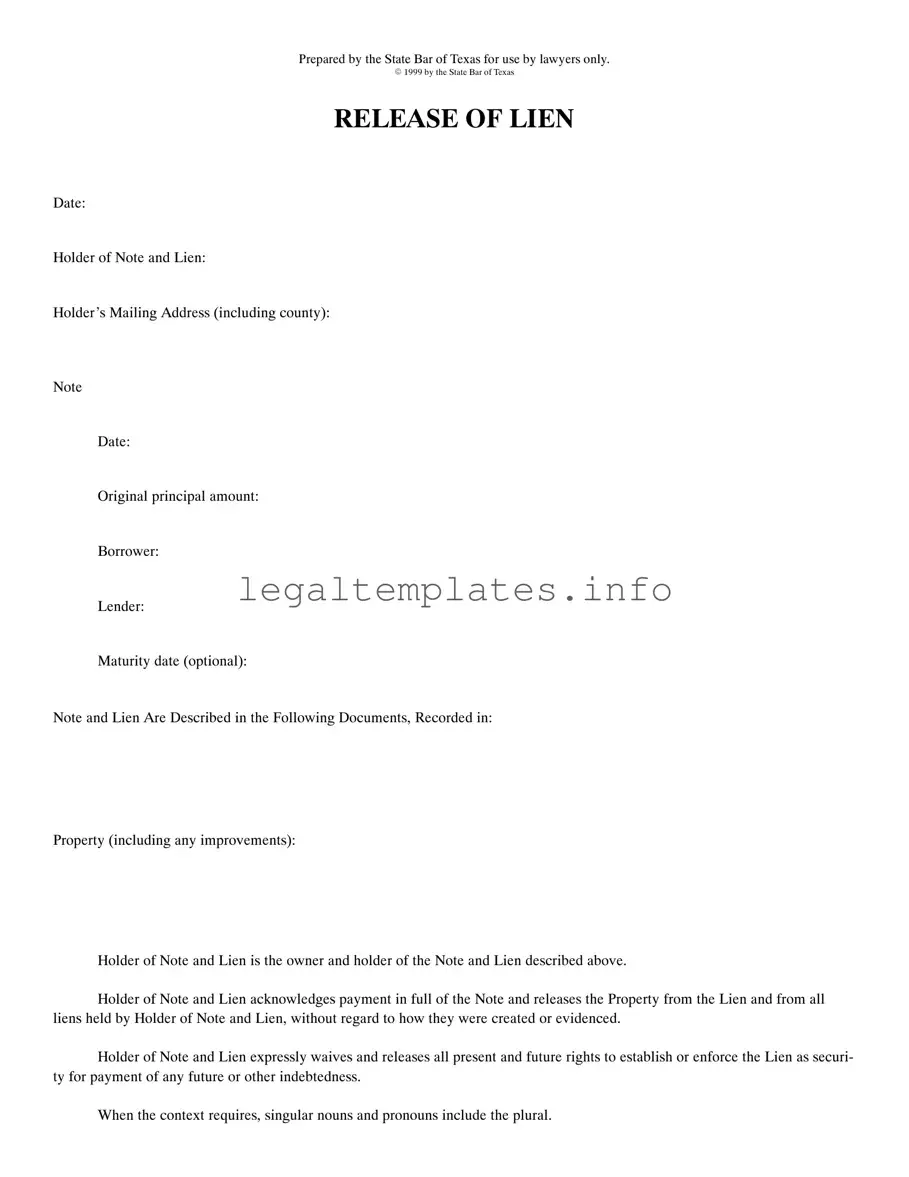

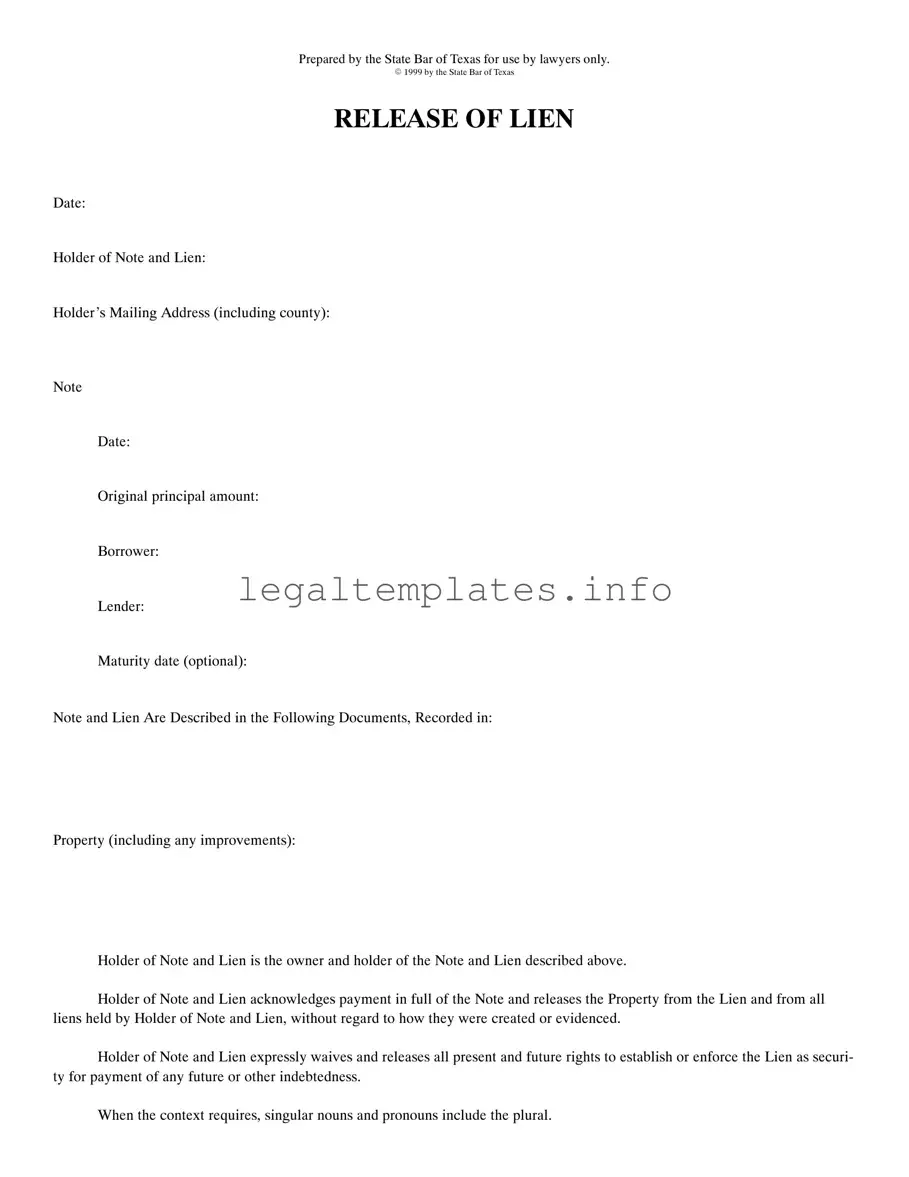

Do I need a lawyer to prepare the Release of Lien form?

The form was prepared by the State Bar of Texas expressly for use by lawyers. While it might be possible for individuals to fill out and file the form on their own, seeking the advice or services of a lawyer can ensure that the form is completed accurately and in compliance with Texas law.

Where do I file the completed Release of Lien form?

Once properly executed and notarized, the Release of Lien form should be filed with the county clerk in the county where the property is located. This ensures that the release is recorded in the public record, officially noting that the lien has been removed from the property.

How does the Release of Lien affect my property title?

Filing a Release of Lien removes the lender’s legal right to seize the property in the event of non-payment, clearing any claims against the property title. This action ensures that the property title is free and clear, which is crucial for future transactions like selling or refinancing your property.

Is recording a Release of Lien mandatory?

Recording a Release of Lien is in the best interest of the property owner, as it officially clears the property of claims or encumbrances related to the lien. While it might not be "mandatory" in every situation, failing to do so can lead to complications when trying to sell or refinance the property.

What information is needed to complete the Release of Lien form?

The form requires information about the holder of the note and lien (lender), the borrower, the original principal amount of the note, the note date, and details about the property. Additionally, information regarding the recorded documents that describe the note and lien are necessary. Accurate completion of the form is crucial for the release to be valid.

Can a Release of Lien be reversed?

Once a Release of Lien has been properly executed and filed, it signifies that the debt secured by the lien has been paid in full. The lienholder expressly waives and releases all future rights to enforce the lien. Reversing a Release of Lien is highly unusual and would likely require court intervention, typically only occurring if there was a mistake or fraud involved in the original release.