Form SSA-44 (11-2019) |

Page 1 of 8 |

Discontinue Prior Editions |

Social Security Administration |

OMB No. 0960-0784 |

Medicare Income-Related Monthly Adjustment Amount -

Life-Changing Event

If you had a major life-changing event and your income has gone down, you may use this form to request a reduction in your income-related monthly adjustment amount. See page 5 for detailed information and line-by-line instructions. If you prefer to schedule an interview with your local Social Security office, call 1-800-772-1213 (TTY 1-800-325-0778).

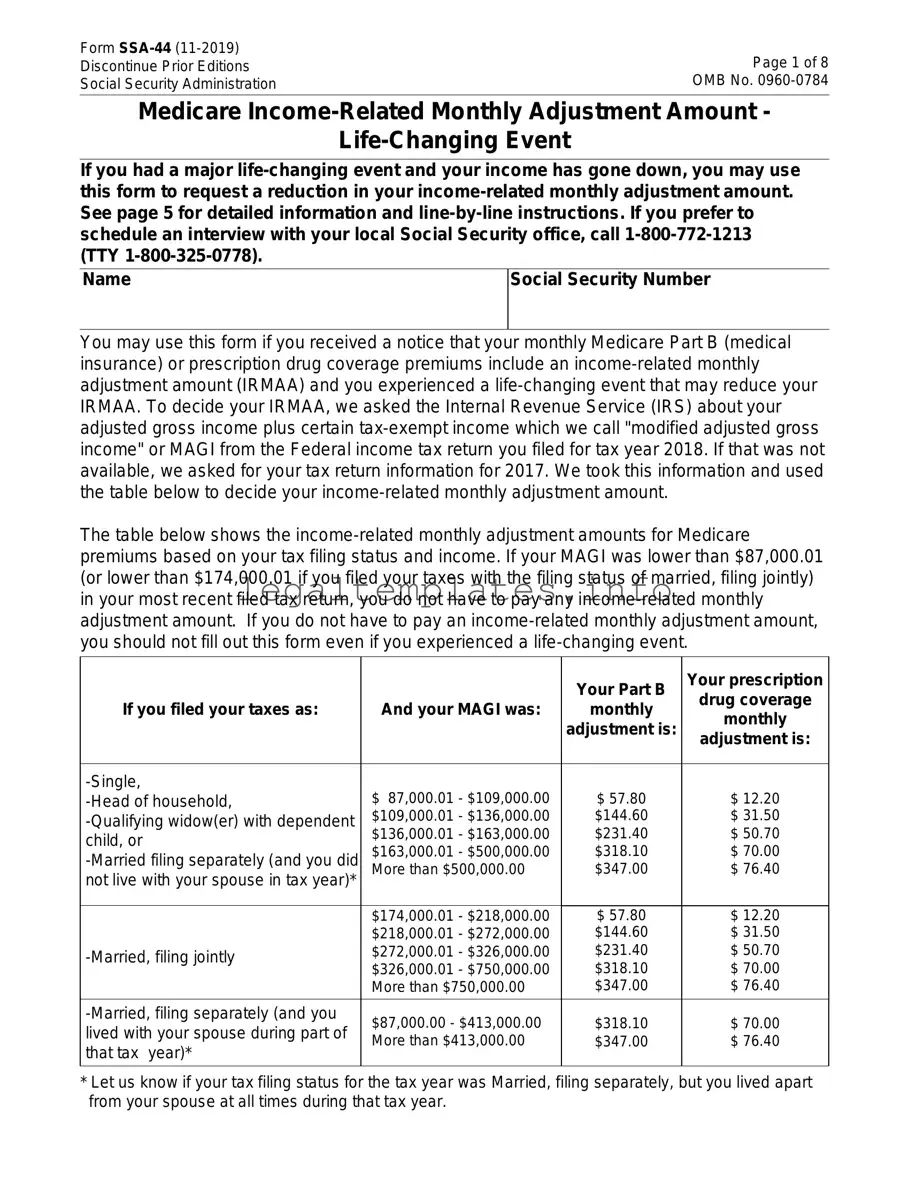

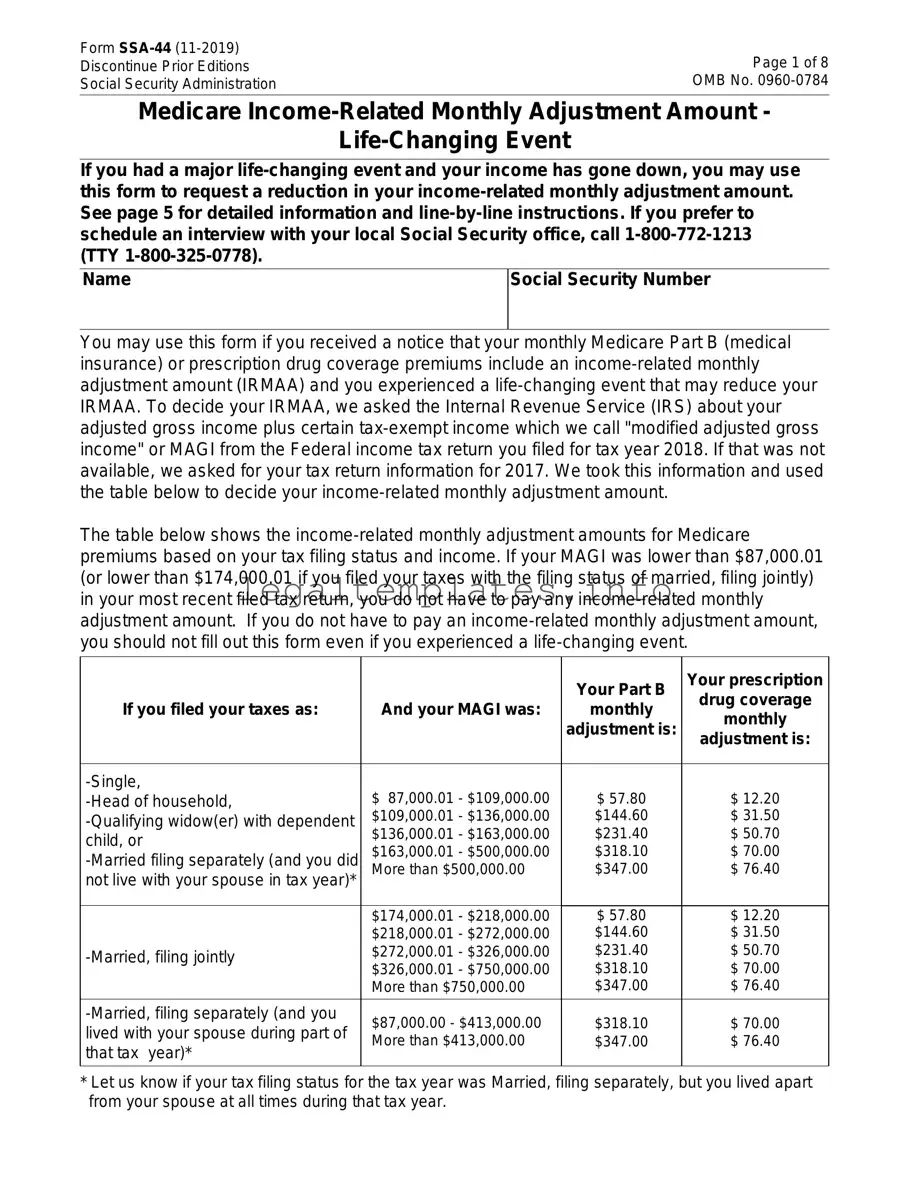

You may use this form if you received a notice that your monthly Medicare Part B (medical insurance) or prescription drug coverage premiums include an income-related monthly adjustment amount (IRMAA) and you experienced a life-changing event that may reduce your IRMAA. To decide your IRMAA, we asked the Internal Revenue Service (IRS) about your adjusted gross income plus certain tax-exempt income which we call "modified adjusted gross income" or MAGI from the Federal income tax return you filed for tax year 2018. If that was not available, we asked for your tax return information for 2017. We took this information and used the table below to decide your income-related monthly adjustment amount.

The table below shows the income-related monthly adjustment amounts for Medicare premiums based on your tax filing status and income. If your MAGI was lower than $87,000.01 (or lower than $174,000.01 if you filed your taxes with the filing status of married, filing jointly) in your most recent filed tax return, you do not have to pay any income-related monthly adjustment amount. If you do not have to pay an income-related monthly adjustment amount, you should not fill out this form even if you experienced a life-changing event.

|

|

|

Your Part B |

Your prescription |

|

|

|

drug coverage |

|

If you filed your taxes as: |

And your MAGI was: |

monthly |

|

monthly |

|

|

|

adjustment is: |

|

|

|

adjustment is: |

|

|

|

|

|

|

|

|

|

|

-Single, |

$ 87,000.01 - $109,000.00 |

$ 57.80 |

$ 12.20 |

|

-Head of household, |

|

-Qualifying widow(er) with dependent |

$109,000.01 - $136,000.00 |

$144.60 |

$ 31.50 |

|

child, or |

$136,000.01 - $163,000.00 |

$231.40 |

$ 50.70 |

|

$163,000.01 - $500,000.00 |

$318.10 |

$ 70.00 |

|

-Married filing separately (and you did |

|

More than $500,000.00 |

$347.00 |

$ 76.40 |

|

not live with your spouse in tax year)* |

|

|

|

|

|

|

|

|

|

|

$174,000.01 - $218,000.00 |

$ 57.80 |

$ 12.20 |

|

|

$218,000.01 - $272,000.00 |

$144.60 |

$ 31.50 |

|

-Married, filing jointly |

$272,000.01 - $326,000.00 |

$231.40 |

$ 50.70 |

|

$326,000.01 - $750,000.00 |

$318.10 |

$ 70.00 |

|

|

|

|

More than $750,000.00 |

$347.00 |

$ 76.40 |

|

-Married, filing separately (and you |

$87,000.00 - $413,000.00 |

$318.10 |

$ 70.00 |

|

lived with your spouse during part of |

|

More than $413,000.00 |

$347.00 |

$ 76.40 |

|

that tax year)* |

|

|

|

|

|

|

|

|

|

*Let us know if your tax filing status for the tax year was Married, filing separately, but you lived apart from your spouse at all times during that tax year.

Form SSA-44 (11-2019) |

Page 2 of 8 |

STEP 1: Type of Life-Changing Event

Check ONE life-changing event and fill in the date that the event occurred (mm/dd/yyyy). If you had more than one life-changing event, please call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).

Marriage |

Work Reduction |

Divorce/Annulment |

Loss of Income-Producing Property |

Death of Your Spouse |

Loss of Pension Income |

Work Stoppage |

Employer Settlement Payment |

Date of life-changing event: |

|

|

|

mm/dd/yyyy |

STEP 2: Reduction in Income

Fill in the tax year in which your income was reduced by the life-changing event (see instructions on page 6), the amount of your adjusted gross income (AGI, as used on line 7 of IRS form 1040) and tax-exempt interest income (as used on line 2a of IRS form 1040), and your tax filing status.

Adjusted Gross Income

$ __ __ __ __ __ __ . __ __

Tax-Exempt Interest

$ __ __ __ __ __ __ . __ __

Tax Filing Status for this Tax Year (choose ONE ):

Single |

Head of Household |

Married, Filing Jointly |

Married, Filing Separately |

Qualifying Widow(er) with Dependent Child

STEP 3: Modified Adjusted Gross Income

Will your modified adjusted gross income be lower next year than the year in Step 2?

No - Skip to STEP 4

No - Skip to STEP 4

Yes - Complete the blocks below for next year

Yes - Complete the blocks below for next year

Tax Year |

Estimated Adjusted Gross Income |

|

Estimated Tax-Exempt Interest |

2 0 __ __ |

$ __ __ __ __ __ __. __ __ |

|

$ __ __ __ __ __ __. __ __ |

|

|

|

|

Expected Tax Filing Status for this Tax Year (choose |

ONE ): |

Single

Single

Married, Filing Jointly

Head of Household

Head of Household

Married, Filing Separately

Qualifying Widow(er) with Dependent Child

Form SSA-44 (11-2019) |

Page 3 of 8 |

STEP 4: Documentation

Provide evidence of your modified adjusted gross income (MAGI) and your life-changing event. You can either:

1.Attach the required evidence and we will mail your original documents or certified copies back to you;

OR

2.Show your original documents or certified copies of evidence of your life-changing event and modified adjusted gross income to an SSA employee.

Note: You must sign in Step 5 and attach all required evidence. Make sure that you provide your current address and a phone number so that we can contact you if we have any questions about your request.

STEP 5: Signature

PLEASE READ THE FOLLOWING INFORMATION CAREFULLY BEFORE SIGNING THIS FORM.

I understand that the Social Security Administration (SSA) will check my statements with records from the Internal Revenue Service to make sure the determination is correct.

I declare under penalty of perjury that I have examined the information on this form and it is true and correct to the best of my knowledge.

I understand that signing this form does not constitute a request for SSA to use more recent tax year information unless it is accompanied by:

•Evidence that I have had the life-changing event indicated on this form;

•A copy of my Federal tax return; or

•Other evidence of the more recent tax year's modified adjusted gross income.

Form SSA-44 (11-2019) |

Page 4 of 8 |

|

|

THE PRIVACY ACT

We are required by sections 1839(i) and 1860D-13 of the Social Security Act to ask you to give us the information on this form. This information is needed to determine if you qualify for a reduction in your monthly Medicare Part B and/or prescription drug coverage income-related monthly adjustment amount (IRMAA). In order for us to determine if you qualify, we need to evaluate information that you provide to us about your modified adjusted gross income. Although the responses are voluntary, if you do not provide the requested information we will not be able to consider a reduction in your IRMAA.

We rarely use the information you supply for any purpose other than for determining a potential reduction in IRMAA. However, the law sometimes requires us to give out the facts on this form without your consent. We may release this information to another Federal, State, or local government agency to assist us in determining your eligibility for a reduction in your IRMAA, if Federal law requires that we do so, or to do the research and audits needed to administer or improve our efforts for the Medicare program.

We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, state or local government agencies. We will also compare the information you give us to your tax return records maintained by the IRS. The law allows us to do this even if you do not agree to it. Information from these matching programs can be used to establish or verify a person’s eligibility for Federally funded or administered benefit programs and for repayment of payments or delinquent debts under these programs.

Explanations about these and other reasons why information you provide us may be used or given out are available in Systems of Records Notice 60-0321 (Medicare Database File). The Notice, additional information about this form, and any other information regarding our systems and programs, are available on-line at www.socialsecurity.gov or at your local Social Security office.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 45 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO

YOUR LOCAL SOCIAL SECURITY OFFICE. The office is listed under U. S. Government agencies in your telephone directory or you may call Social Security at 1-800-772-1213 (TTY 1-800-325-0778). You may send comments on our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD 21235-6401. Send only comments relating to our time estimate to this address, not the completed form.

Form SSA-44 (11-2019) |

Page 5 of 8 |

INSTRUCTIONS FOR COMPLETING FORM SSA-44

Medicare Income-Related Monthly Adjustment Amount

Life-Changing Event--Request for Use of More Recent Tax Year Information

You do not have to complete this form in order to ask that we use your information about your modified adjusted gross income for a more recent tax year. If you prefer, you may call

1-800-772-1213 and speak to a representative from 7 a.m. until 7 p.m. on business days to request an appointment at one of our field offices. If you are hearing-impaired, you may call our TTY number, 1-800-325-0778.

Identifying Information

Print your full name and your own Social Security Number as they appear on your Social Security card. Your Social Security Number may be different from the number on your Medicare card.

STEP 1

You should choose only one life-changing event on the list. If you experienced more than one life-changing event, please call your local Social Security office at 1-800-772-1213 (TTY

1-800-325-0778). Fill in the date that the life-changing event occurred. The life-changing event date must be in the same year or an earlier year than the tax year you ask us to use to decide your income-related premium adjustment. For example, if we used your 2016 tax information to determine your income-related monthly adjustment amount for 2018, you can request that we use your 2017 tax information instead if you experienced a reduction in your income in 2017 due to a life-changing event that occurred in 2017 or an earlier year.

|

Life-Changing Event |

Use this category if... |

|

|

Marriage |

You entered into a legal marriage. |

|

|

|

|

|

|

Divorce/Annulment |

Your legal marriage ended, and you will not file a joint return |

|

|

with your spouse for the year. |

|

|

|

|

|

Death of Your Spouse |

Your spouse died. |

|

|

|

|

|

|

Work Stoppage or Reduction |

You or your spouse stopped working or reduced the hours |

|

|

that you work. |

|

|

|

|

|

|

You or your spouse experienced a loss of income-producing |

|

|

|

property that was not at your direction (e.g., not due to the |

|

|

Loss of Income-Producing |

sale or transfer of the property). This includes loss of real |

|

|

property in a Presidentially or Gubernatorially-declared |

|

|

Property |

|

|

disaster area, destruction of livestock or crops due to natural |

|

|

|

|

|

|

disaster or disease, or loss of property due to arson, or loss |

|

|

|

of investment property due to fraud or theft. |

|

|

|

|

|

|

Loss of Pension Income |

You or your spouse experienced a scheduled cessation, |

|

|

termination, or reorganization of an employer's pension plan. |

|

|

|

|

|

|

You or your spouse receive a settlement from an employer |

|

|

Employer Settlement Payment |

or former employer because of the employer's bankruptcy or |

|

|

|

reorganization. |

|

|

|

|

|

Form SSA-44 (11-2019) |

Page 6 of 8 |

INSTRUCTIONS FOR COMPLETING FORM SSA-44

STEP 2

Supply information about the more recent year's modified adjusted gross income (MAGI). Note that this year must reflect a reduction in your income due to the life-changing event you listed in Step 1. A change in your tax filing status due to the life-changing event might also reduce your income-related monthly adjustment amount. Your MAGI is your adjusted gross income as used on line 7 of IRS form 1040 plus your tax-exempt interest income as used on line 2a of IRS form 1040. We used your MAGI and your tax filing status to determine your income-related monthly adjustment amount.

Tax Year

•Fill in both empty spaces in the box that says “20_ _". The year you choose must be more recent than the year of the tax return information we used. The letter that we sent you tells you what tax year we used.

Choose this year (the "premium year") - if your modified adjusted gross income is lower this year than last year. For example, if you request that we adjust your income-related premium for 2020, use your estimate of your 2019 MAGI if:

1.Your income was not reduced until 2020; or

2.Your income was reduced in 2019, but will be lower in 2020.

Choose last year (the year before the "premium year," which is the year for which you want us to adjust your IRMAA) - if your MAGI is not lower this year than last year. For example, if you request that we adjust your 2020 income-related monthly adjustment amounts and your income was reduced in 2018 by a life-changing event AND will be no lower in 2020, use your tax information for 2019.

Exception: If we used IRS information about your MAGI 3 years before the premium year, you may ask us to use information from 2 years before the premium year. For example, if we used your income tax return for 2017 to decide your 2020 IRMAA, you can ask us to use your 2018 information.

• If you have any questions about what year you should use, you should call SSA.

Adjusted Gross Income

•Fill in your actual or estimated adjusted gross income for the year you wrote in the “tax year” box. Adjusted gross income is the amount on line 7 of IRS form 1040. If you are providing an estimate, your estimate should be what you expect to enter on your tax return for that year.

Tax-exempt Interest Income

•Fill in your actual or estimated tax-exempt interest income for the tax year you wrote in the “tax year” box. Tax-exempt interest income is the amount reported on line 2a of IRS form 1040. If you are providing an estimate, your estimate should be what you expect to enter on your tax return for that year.

Filing Status

•Check the box in front of your actual or expected tax filing status for the year you wrote in the “tax year” box.

Form SSA-44 (11-2019) |

Page 7 of 8 |

INSTRUCTIONS FOR COMPLETING FORM SSA-44

STEP 3

Complete this step only if you expect that your MAGI for next year will be even lower and will reduce your IRMAA below what you told us in Step 2 using the table on page 1. We will record this information and use it next year to determine your Medicare income-related monthly adjustment amounts. If you do not complete Step 3, we will use the information from Step 2 next year to determine your income-related monthly adjustment amounts, unless one of the conditions described in “Important Facts” on page 8 occurs.

Tax Year

•Fill in both empty spaces in the box that says “20 _ _ ” with the year following the year you wrote in Step 2. For example, if you wrote "2020" in Step 2, then write "2021" in Step 3.

Adjusted Gross Income

•Fill in your estimated adjusted gross income for the year you wrote in the “tax year” box. Adjusted gross income is the amount you expect to enter on line 7 of IRS form 1040 when you file your tax return for that year.

Tax-exempt Interest Income

•Fill in your estimated tax-exempt interest income for the tax year you wrote in the “tax year” box. Tax-exempt interest income is the amount you expect to report on line 2a of IRS form 1040.

Filing Status

•Check the box in front of your expected tax filing status for the year you wrote in the “tax year” box.

STEP 4

Provide your required evidence of your MAGI and your life-changing event.

Modified Adjusted Gross Income Evidence

If you have filed your Federal income tax return for the year you wrote in Step 2, then you must provide us with your signed copy of your tax return or a transcript from IRS. If you provided an estimate in Step 2, you must show us a signed copy of your tax return when you file your Federal income tax return for that year.

Life-Changing Event Evidence

We must see original documents or certified copies of evidence that the life-changing event occurred. Required evidence is described on the next page. In some cases, we may be able to accept another type of evidence if you do not have a preferred document listed on the next page. Ask a Social Security representative to explain what documents can be accepted.

|

Form SSA-44 (11-2019) |

Page 8 of 8 |

|

|

|

|

Life-Changing Event |

Evidence |

|

|

|

|

Marriage |

An original marriage certificate; or a certified copy of a public record of |

|

marriage. |

|

|

|

Divorce/Annulment |

A certified copy of the decree of divorce or annulment. |

|

|

|

|

Death of Your Spouse |

A certified copy of a death certificate, certified copy of the public record of |

|

death, or a certified copy of a coroner’s certificate. |

|

|

An original signed statement from your employer; copies of pay stubs; |

|

Work Stoppage or |

original or certified documents that show a transfer of your business. |

|

Note: In the absence of such proof, we will accept your signed statement, |

|

Reduction |

|

|

under penalty of perjury, on this form, that you partially or fully stopped |

|

|

working or accepted a job with reduced compensation. |

|

|

|

|

|

An original copy of an insurance company adjuster’s statement of loss or a |

|

Loss of Income- |

letter from a State or Federal government about the uncompensated loss. If |

|

the loss was due to investment fraud (theft), we also require proof of |

|

Producing Property |

|

conviction for the theft, such as a court document citing theft or fraud |

|

|

|

|

relating to you or your spouse's loss. |

|

|

|

|

Loss of Pension |

A letter or statement from your pension fund administrator that explains the |

|

Income |

reduction or termination of your benefits. |

|

|

|

|

Employer Settlement |

A letter from the employer stating the settlement terms of the bankruptcy |

|

Payment |

court and how it affects you or your spouse. |

|

|

|

|

STEP 5 |

|

Read the information above the signature line, and sign the form. Fill in your phone number and current mailing address. It is very important that we have this information so that we can contact you if we have any questions about your request.

Important Facts

•When we use your estimated MAGI information to make a decision about your income-related monthly adjustment amount, we will later check with the IRS to verify your report.

•If you provide an estimate of your MAGI rather than a copy of your Federal tax return, we will ask you to provide a copy of your tax return when you file your taxes.

•If your estimate of your MAGI changes, or you amend your tax return for that reason, you will need to contact us to update our records. If you do not contact us, we may have to make corrections later including retroactive assessments or refunds.

•We will use your estimate provided in Step 2 to make a decision about the amount of your income-related monthly adjustment amounts the following year until:

•IRS sends us your tax return information for the year used in Step 2; or

•You provide a signed copy of your filed Federal income tax return or amended Federal income tax return with a different amount; or

•You provide an updated estimate.

•If we used information from IRS about a tax year when your filing status was Married filing separately, but you lived apart from your spouse at all times during that year, you should contact us at 1-800-772-1213 (TTY 1-800-325-0778) to explain that you lived apart from your spouse. Do not use this form to report this change.

No - Skip to STEP 4

No - Skip to STEP 4

Yes - Complete the blocks below for next year

Yes - Complete the blocks below for next year

Single

Single

Head of Household

Head of Household