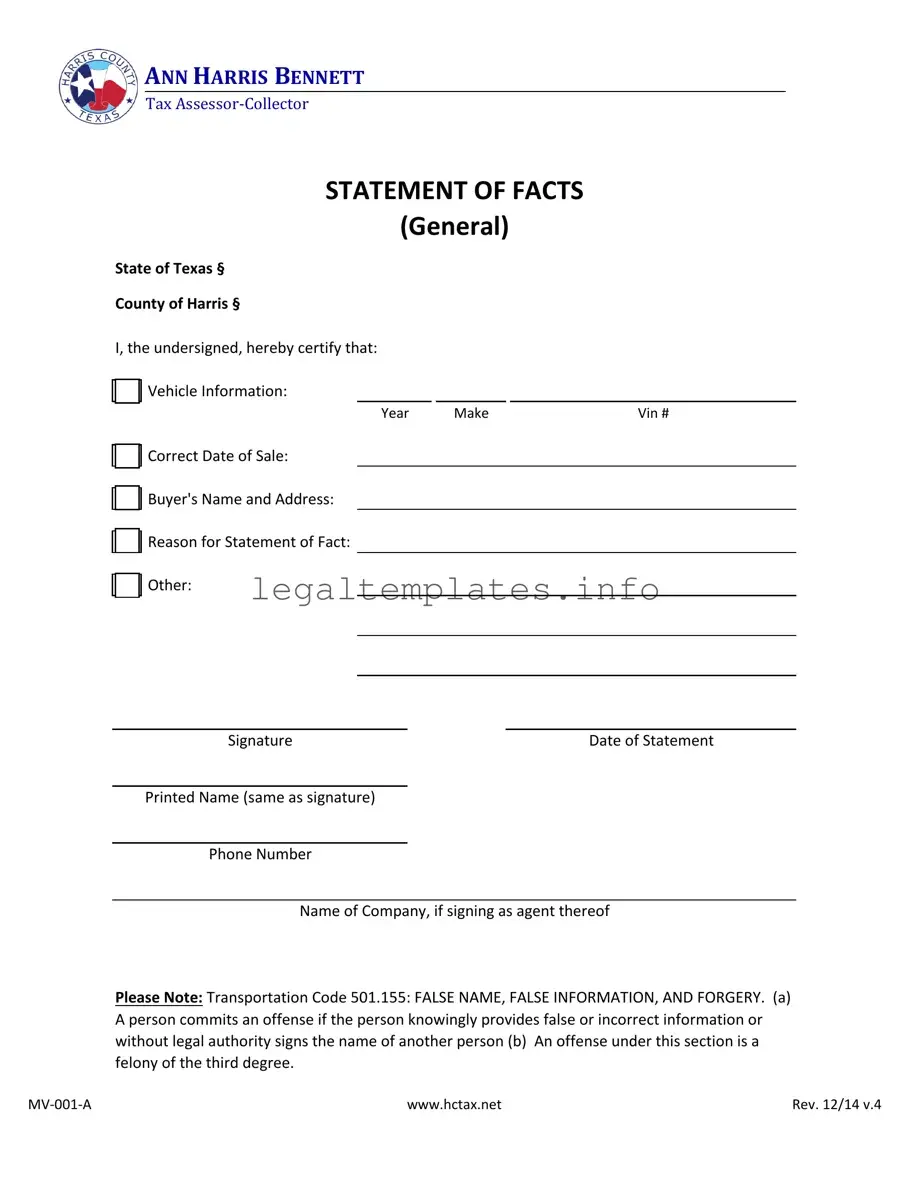

The Affidavit of Title, commonly used in real estate transactions, bears resemblance to the Statement of Fact form used in Texas. Like the Statement of Fact, an Affidavit of Title serves as a sworn statement, detailing essential information about the property in question and the rightful ownership. Both documents are used to attest to the accuracy of certain statements, offering legal protection against fraudulent representations. Where the Statement of Fact might be applied to a broader array of situations, including vehicle transactions, the Affidavit of Title is specifically tailored to the transfer of real estate.

The Bill of Sale is another document similar to the Statement of Fact. It is used to transfer ownership of personal property, such as vehicles or boats, from a seller to a buyer. Like the Statement of Fact, it includes details about the item being sold, the sale date, and the parties involved. Both documents facilitate transactions by providing a record of transfer, although the Statement of Fact can also be used to correct or clarify details of the transaction after the fact.

A Power of Attorney (POA) shares some similarities with the Statement of Fact. Both documents can be used to delegate authority or clarify situations involving third parties. While the POA gives one party the legal authority to act on behalf of another in specific scenarios, the Statement of Fact may be used to declare certain truths or correct misinformation, potentially on behalf of someone else, as when signing as an agent of a company.

The Correction Statement mirrors the Statement of Fact in its fundamental purpose. Designed to amend previously submitted information, Correction Statements are often used within various bureaucratic processes to ensure the accuracy of official records. The Statement of Fact can serve a similar function, particularly when details about a vehicle sale or ownership need to be clarified or corrected after the initial transaction or document submission.

Warranty Deeds, while specific to the transfer of real estate with guarantees about the title's status, overlap with the Statement of Fact in their declaratory nature. Both documents involve the declaration of facts regarding ownership and the condition of the item or property in question. However, a Warranty Deed specifically guarantees that the property is free from liens and claims, whereas a Statement of Fact may be used more broadly in various contexts beyond real estate.

The Release of Liability form, often used in the sale of vehicles, shares the protective function of the Statement of Fact. By signing a Release of Liability, the seller declares that they are relinquishing their responsibility over the vehicle, shifting potential legal burdens onto the buyer. The Statement of Fact might also be used within this context, particularly to clarify or rectify details of the vehicle's sale to protect both parties' interests.

A Non-Disclosure Agreement (NDA) and the Statement of Fact, while serving different primary purposes, both involve legally binding declarations. An NDA is used to protect sensitive information, with parties agreeing not to disclose agreed-upon confidential material. The Statement of Fact, however, is a declaration of truths regarding a transaction or identification details, used to ensure transparency and rectify errors. The commonality lies in their use to establish clear, legally recognized records of agreement or fact.

The Quitclaim Deed, akin to the Statement of Fact, is used in real estate to transfer any ownership interest the grantor might have in the property, without making any guarantees about the extent of that interest. It's similar to the Statement of Fact in that it serves to clarify and rectify details about ownership. However, the Quitclaim Deed is specific to real estate transactions and is more about the conveyance of rights or claims without specifying the nature of those rights.