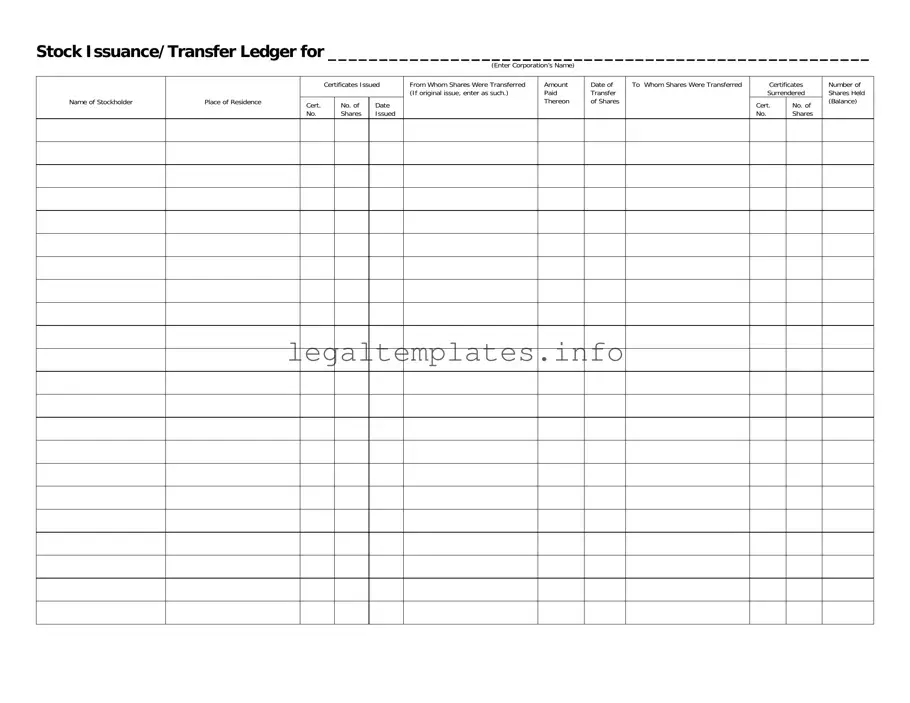

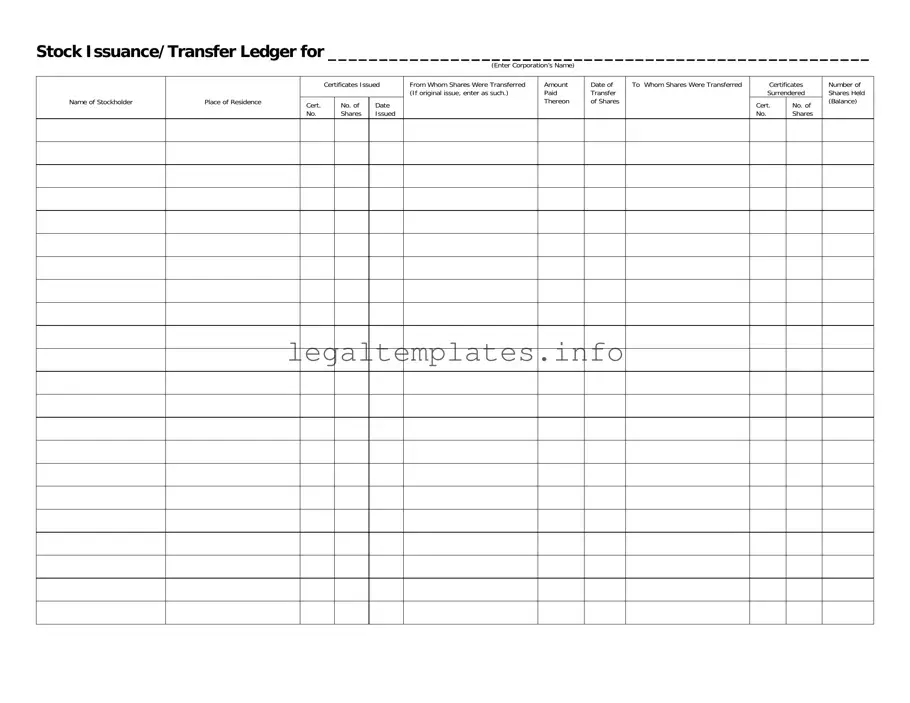

What is a Stock Transfer Ledger form?

A Stock Transfer Ledger form is a document used by corporations to keep a detailed record of the issuance and transfer of its stock shares. It includes information such as the stockholder's name and residence, certificate numbers, the number of shares issued or transferred, payment amounts, and the details of the previous and new ownership of the shares. This form is vital for maintaining accurate and up-to-date information on the ownership of the corporation's stock.

Why is the Stock Transfer Ledger important?

This ledger is crucial for several reasons. It ensures transparency in the ownership and transfer of shares, facilitates the accurate payment of dividends, and is essential for the corporation to meet legal and regulatory requirements. Additionally, it helps in resolving disputes over ownership and in making informed decisions regarding the corporation's management and policies.

Who should fill out this form?

The responsibility of filling out this form typically falls on the corporation's secretary or another designated official in charge of the company's records. It's important that the individual managing this ledger has a thorough understanding of the corporation's stock transactions to ensure accuracy and compliance with relevant laws and regulations.

What should be included when entering a new stock issuance in the ledger?

When entering a new stock issuance, it is important to include the name and residence of the stockholder, the certificate number, the date and number of shares issued, the amount paid for the shares, and a note that it's an original issue in the respective sections of the form.

How is a transfer of stock recorded in the ledger?

To accurately record a stock transfer, you should note the date of the transfer, the names of the transferor and transferee, the certificate numbers of the surrendered certificates, the number of shares transferred, and update the number of shares held by each party post-transfer. This ensures a comprehensive record of who owns what and when the ownership change took place.

Is it necessary to keep this ledger up to date?

Absolutely. Keeping this ledger current is not just a matter of good record-keeping; it's a legal requirement for most corporations. Regular updates ensure that the corporation has a real-time record of its stock ownership, which is crucial for decision-making, reporting, and compliance purposes.

Can the Stock Transfer Ledger be maintained electronically?

Yes, while traditional paper ledgers were common in the past, many corporations now maintain their Stock Transfer Ledgers electronically. This can make the ledger easier to update and audit. However, it's important to ensure that the electronic system is secure, reliable, and complies with applicable laws and regulations regarding digital record-keeping.

What should be done if errors are found in the ledger?

If errors are discovered in the Stock Transfer Ledger, they should be corrected as soon as possible. This might involve consulting the original documentation of the stock issuance or transfer to verify the correct information. It's critical that any corrections are clearly documented, including a note of the error, how it was corrected, and the date of correction, to maintain the integrity of the ledger.