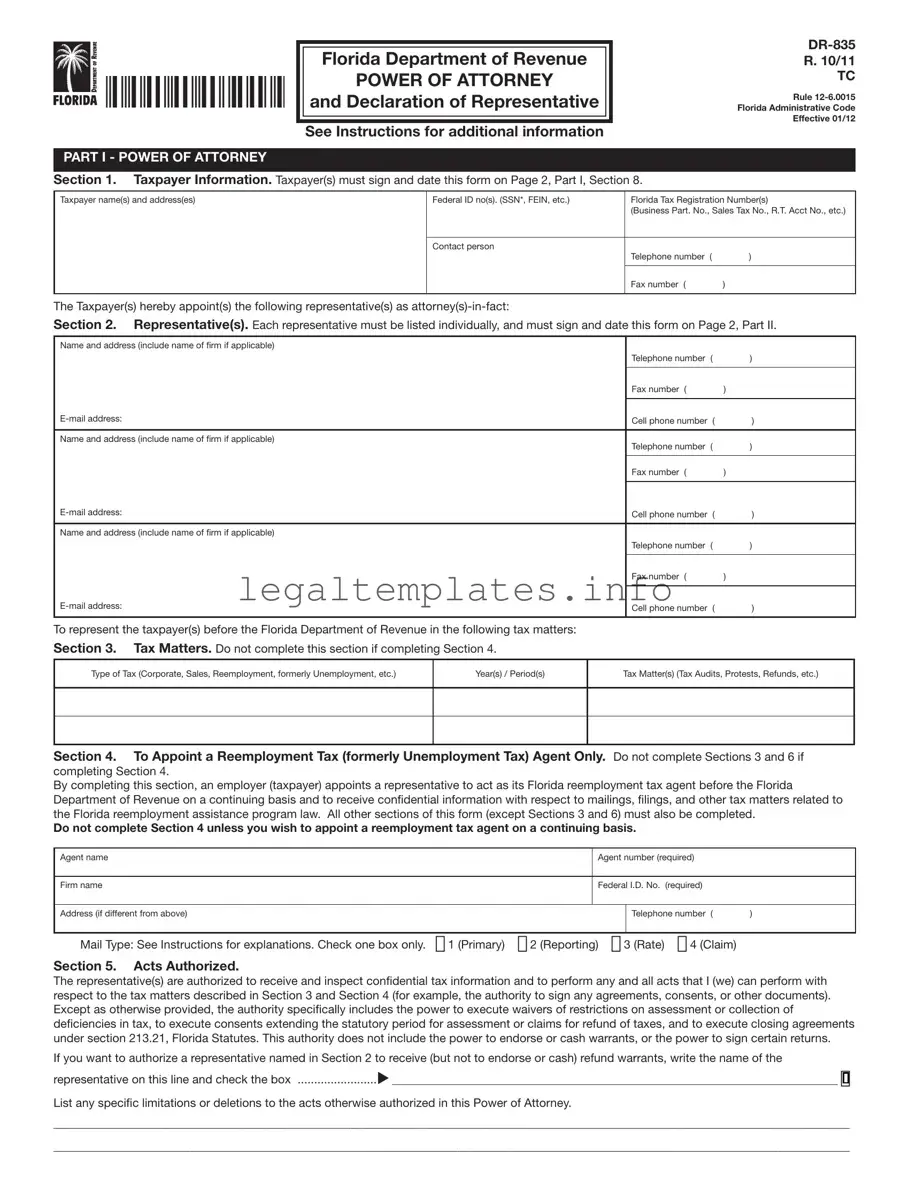

I |

|

|

DR-835 |

|

111111111111111111111111111111111111111 |

R. 10/11 |

|

|

Page 2 |

|

|

|

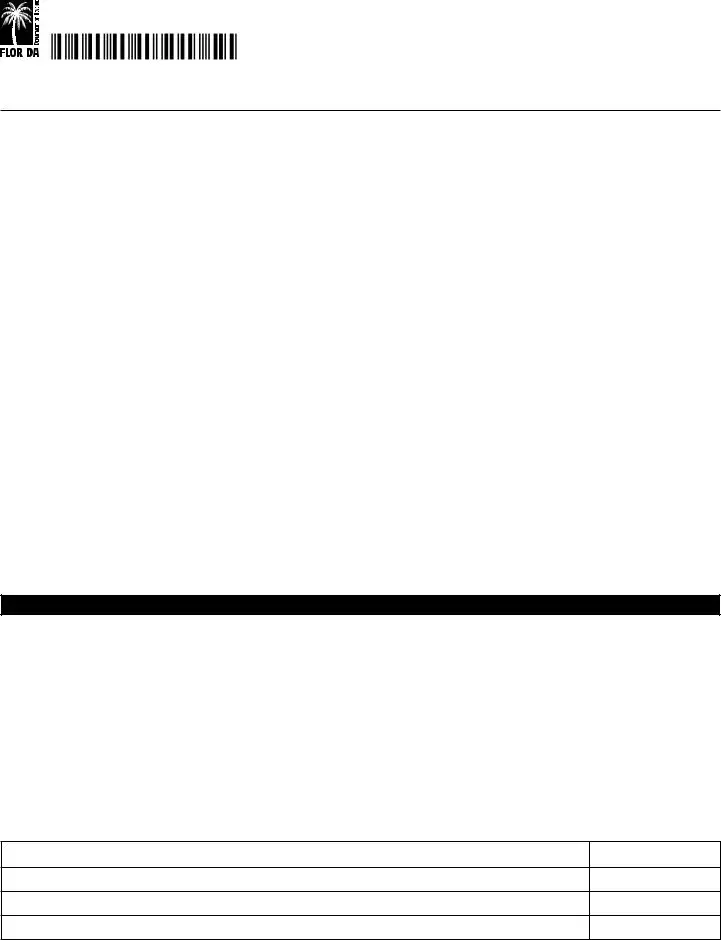

Florida Tax Registration Number: |

Taxpayer Name(s): |

Federal Identifcation Number: |

•Taxpayer(s) must complete Page 1 of this Power of Attorney or it will not be processed.

Section 6. Notices and Communication. Do not complete Section 6 if completing Section 4.

•Notices and other written communications will be sent to the first representative listed in Part I, Section 2, unless the taxpayer selects one of the options below. Receipt by either the representative or the taxpayer will be considered receipt by both.

a. |

If you want notices and communications sent to both you and your representative, check this box |

u |

❑ |

b. |

If you want notices or communications sent to you and not your representative, check this box |

u |

❑ |

Certain computer-generated notices and other written communications cannot be issued in duplicate due to current system constraints. Therefore, we will send these communications to only the taxpayer at his or her tax registration address.

Section 7. Retention / Nonrevocation of Prior Power(s) of Attorney.

The fling of this Power of Attorney will not revoke earlier Power(s) of Attorney on fle with the Florida Department of Revenue, even for the same tax matters and years or periods covered by this document. If you want to revoke a prior Power of

Attorney, check this box |

u ❑ |

You must attach a copy of any Power of Attorney you wish to revoke.

Section 8. Signature of Taxpayer(s).

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If signed by a corporate offcer, partner, member/managing member, guardian, tax matters partner/person, executor, receiver, administrator, trustee, or fduciary on behalf of the taxpayer, I declare under penalties of perjury that I have the authority to execute this form on behalf of the taxpayer.

Under penalties of perjury, I (we) declare that I (we) have read the foregoing document, and the facts stated in it are true.

If this Power of Attorney is not signed and dated, it will be returned.

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

PART II - DECLARATION OF REPRESENTATIVE

Under penalties of perjury, I declare that:

•I am familiar with the mandatory standards of conduct governing representation before the Department of Revenue, including Rules 12-6.006 and 28-106.107 of the Florida Administrative Code, as amended.

•I am familiar with the law and facts related to this matter and am qualified to represent the taxpayer(s) in this matter.

•I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified therein, and to receive and inspect confidential taxpayer information.

•I am one of the following:

a.Attorney - a member in good standing of the bar of the highest court of the jurisdiction shown below.

b.Certifed Public Accountant - duly qualifed to practice as a certifed public accountant in the jurisdiction shown below.

c.Enrolled Agent – enrolled as an agent pursuant to the requirements of Treasury Department Circular Number 230.

d.Former Department of Revenue Employee. As a representative, I cannot accept representation in a matter upon which I had direct involvement while I was a public employee.

e.Reemployment Tax Agent authorized in Section 4 of this form.

f.Other Qualifed Representative

•I have read the foregoing Declaration of Representative and the facts stated in it are true.