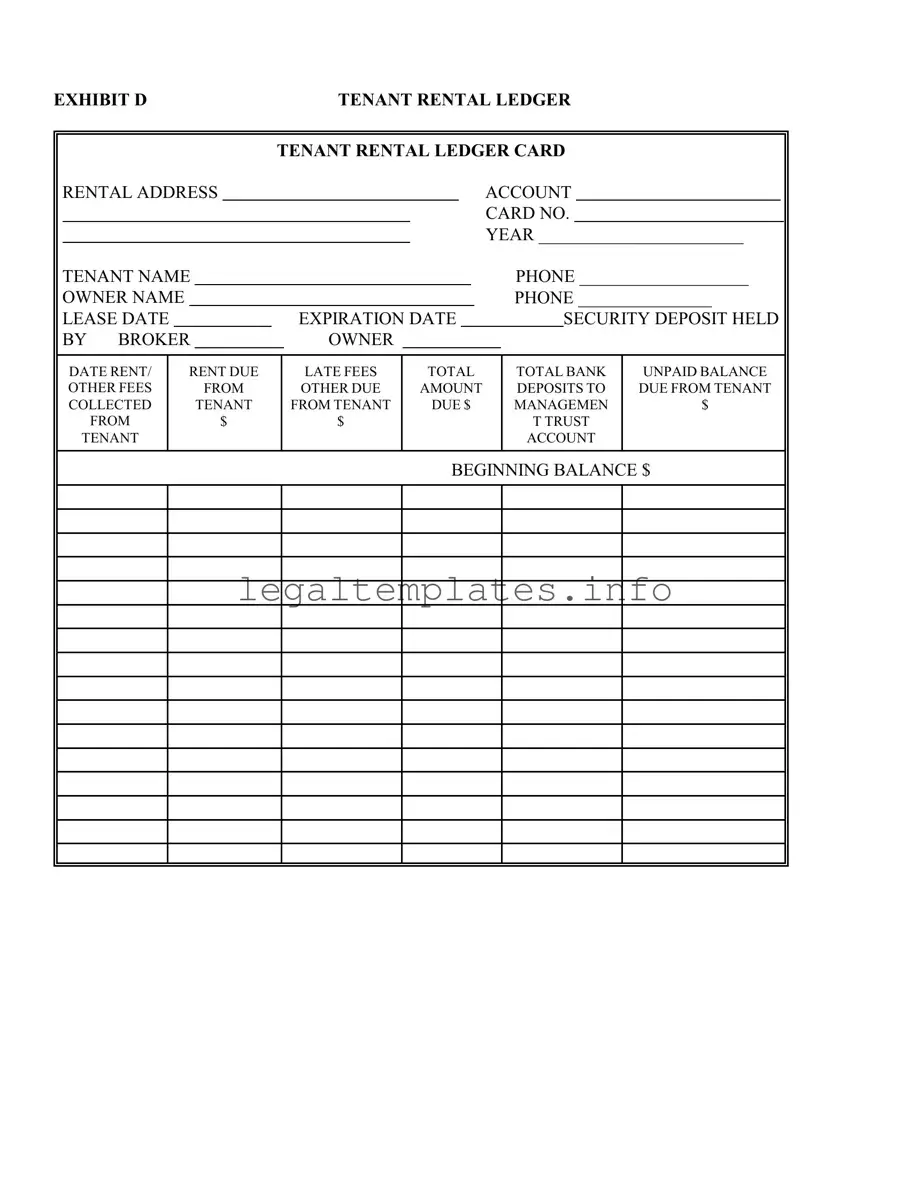

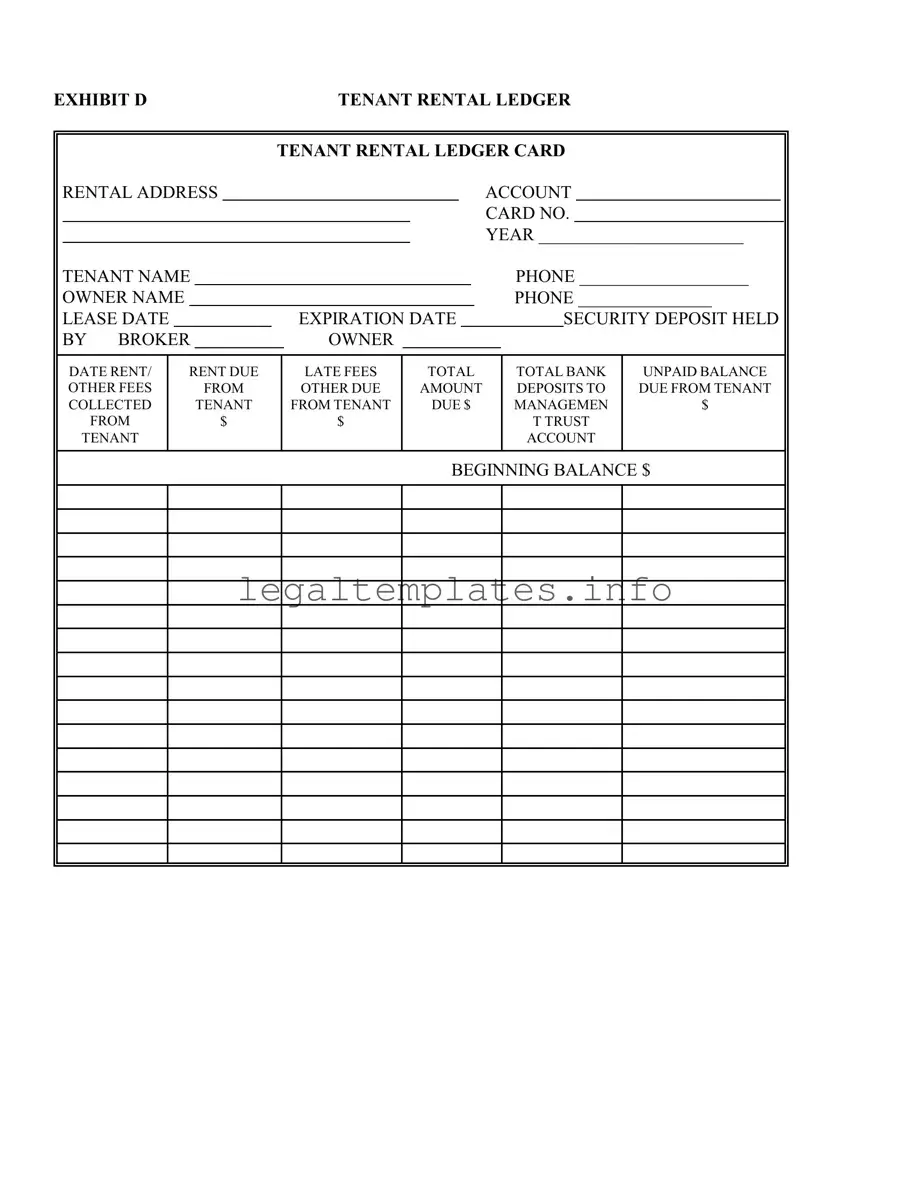

One common mistake that individuals often make when filling out a Tenant Rental Ledger Card involves not accurately recording the rental address. This ledger is a detailed account of transactions between the tenant and the landlord or management. Providing the precise address, including the apartment or unit number, is crucial for accurate record keeping. Without this information correctly noted, there may be confusion or disputes about which property the records refer to, potentially complicating matters for both parties.

Another frequent oversight is the failure to correctly fill in the Tenant Name and Phone Number. This essential detail ensures clear communication channels between the tenant, the landlord, or the management company. Omitting or inaccurately entering this information could lead to delayed or misdirected communications regarding rent payments, maintenance issues, or other important matters related to the rental agreement.

Incorrectly documenting the Lease Date and Expiration Date can have significant implications for both tenants and landlords. These dates frame the period of the tenancy agreement, impacting notices, renewals, and terminations. Misunderstandings in this area might result in unnecessary disputes, with either party potentially incurring financial or legal consequences from not adhering to correct dates as originally agreed upon in the lease.

A crucial yet often overlooked component of the Tenant Rental Ledger Card is the detail surrounding the Security Deposit. Whether held by the broker or the owner, accurately noting who holds the deposit and the amount is vital. This ensures clarity when the tenancy ends, and discussions regarding the return of the deposit arise. Any inaccuracies here can lead to confusion or disagreement over the rightful amount to be refunded.

Entries related to Rent Due, Late Fees, and Other Fees Due from Tenant need meticulous attention. Incorrect entries or omissions in this section can lead to misunderstandings about the tenant’s financial obligations. This oversight can affect the relationship between tenant and landlord, potentially leading to unnecessary penalties for the tenant or financial shortfalls for the landlord.

Moreover, many people forget to tally the Total Amount Due accurately, which is a critical summary of the tenant's financial obligations at a specific point. This oversight can result in incorrect payments being made or requested, causing financial discrepancies that need to be resolved, possibly requiring adjustments in future transactions.

The Total Bank Deposits section also presents challenges, with individuals often failing to update it correctly after each transaction. This section is intended to reflect the actual deposits made into the management trust account, ensuring clear tracking of payments versus outstanding dues. Inaccurate updates here can lead to an unclear financial standing, hindering accurate financial planning and accountability.

An updated Beginning Balance at the start of each rental period on the ledger is crucial, yet often neglected. This figure sets the baseline for the current period’s transactions. Failing to adjust this balance correctly can lead to miscalculations of dues, payments, and balances moving forward, causing a ripple effect of financial mismanagement on the ledger records.

Finally, inconsistent attention to the Unpaid Balance section, documenting remaining dues, can create a false sense of financial status for both parties. It is essential for tenants to understand their exact financial responsibilities and for landlords to have an accurate accounting of receivables. Mismanagement in this area can lead to undue financial pressure on tenants or affect the landlord's cash flow management.