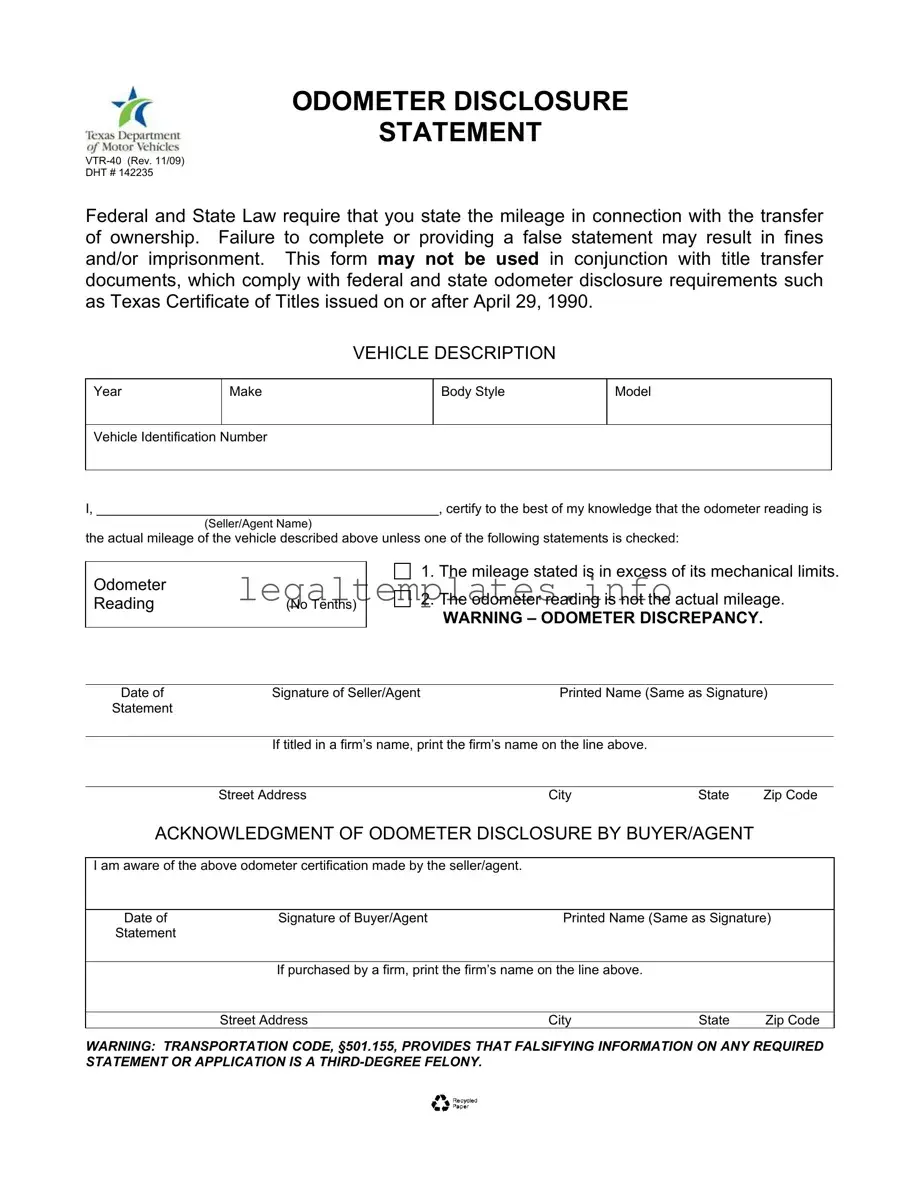

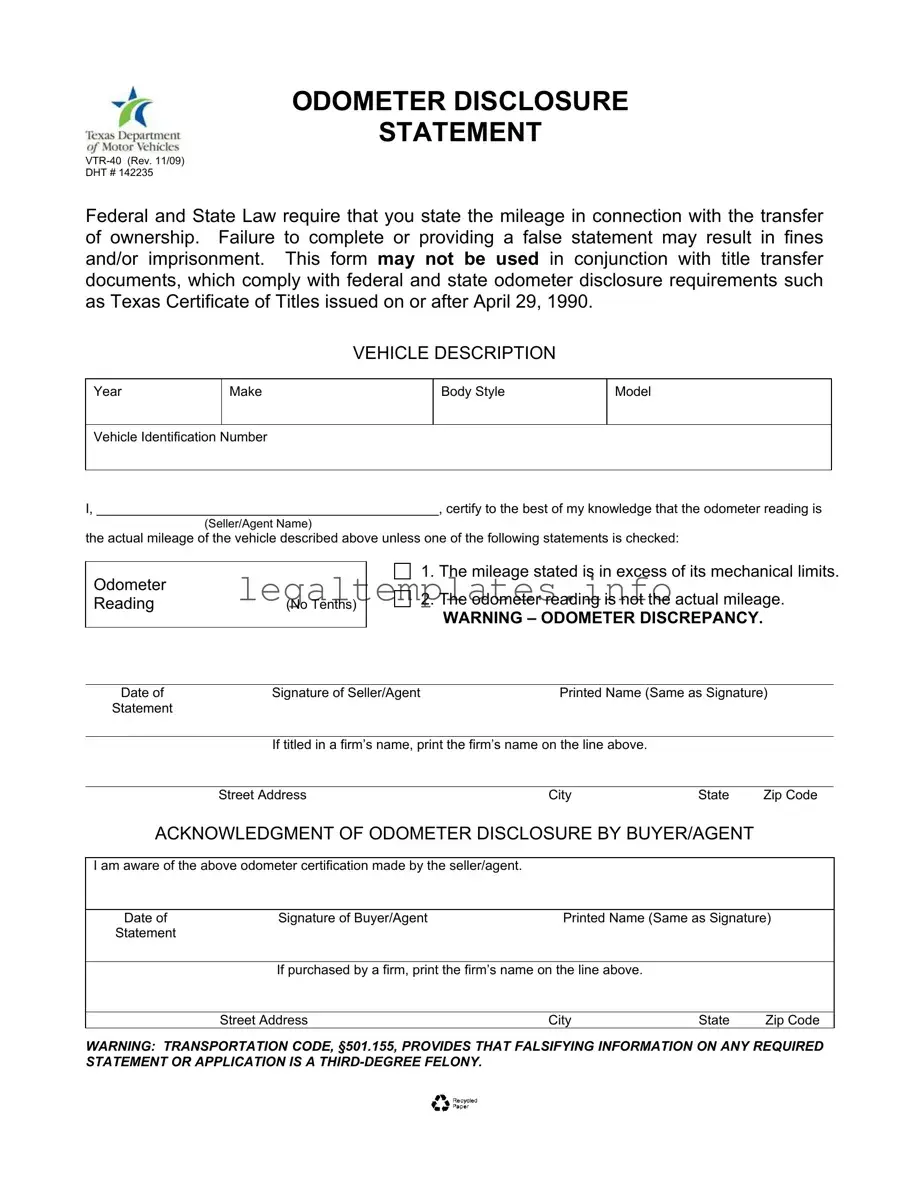

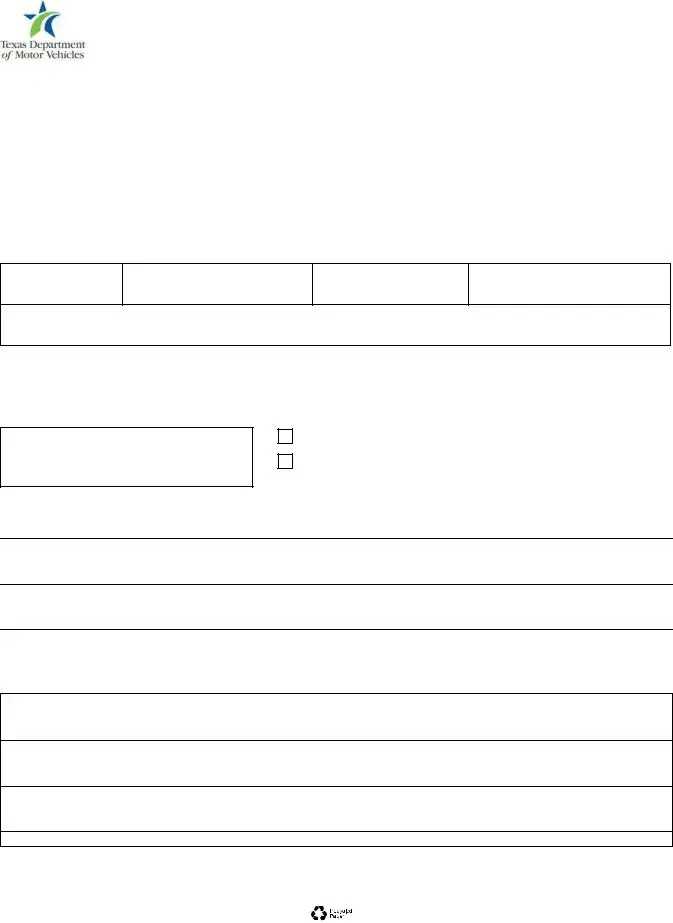

The Texas Odometer Statement form shares similarities with the Vehicle Bill of Sale document. Both are integral in the process of transferring vehicle ownership and ensure that all parties are aware of the condition and history of the vehicle. While the Odometer Statement focuses specifically on disclosing the accurate mileage of the vehicle to prevent odometer fraud, the Bill of Sale typically includes this information along with the sale price, vehicle description, and details of the buyer and seller. Each document serves to create transparency and trust in vehicle transactions.

Another document akin to the Texas Odometer Statement is the Vehicle Title itself. This document is the official record of ownership and often requires an odometer disclosure statement as part of the transfer of title process. Like the Odometer Statement, the title includes essential information such as the year, make, model, and Vehicle Identification Number (VIN). Both documents are crucial for maintaining a transparent and legal record of ownership and the vehicle's history.

The Vehicle Registration form is also similar to the Texas Odometer Statement in that it is a necessary document for vehicle owners. While the Odometer Statement details the vehicle's mileage, the registration form identifies the vehicle and its owner, along with proof that the vehicle is legally allowed to operate on public roads. Both documents contribute to the regulatory framework that promotes safety and accountability in vehicle ownership and operation.

A Lease Agreement for a vehicle shares aspects with the Texas Odometer Statement as well. When leasing a vehicle, accurate mileage is crucial for determining the value of the lease and for setting terms around mileage limits. Like the Odometer Statement, a Lease Agreement protects both parties by documenting the condition and expectations regarding the vehicle's use, ensuring fairness and clarity in the leasing process.

The Loan Agreement for an automobile purchase can be likened to the Texas Odometer Statement because both are key in the vehicle purchase process. A Loan Agreement outlines the financial terms of the vehicle purchase, including the amount financed and the repayment schedule. The Odometer Statement, by confirming the vehicle's mileage, helps in determining the vehicle’s value, directly impacting the loan terms. Each document contributes to a clear, legal foundation for the financial aspects of buying a vehicle.

An Insurance Policy for a vehicle is similar to the Texas Odometer Statement as both impact vehicle valuation and the terms of an agreement. Insurance policies take into account the vehicle's mileage, which can affect premiums and coverage options. Just as the Odometer Statement aims to ensure honesty and transparency about a vehicle's condition, an insurance policy uses this and other information to assess risk and provide appropriate coverage.

The Vehicle Service Record is another document that parallels the Texas Odometer Statement. Service records document the maintenance history of a vehicle, including odometer readings at the time of each service. This correlation highlights the importance of accurate mileage in assessing a vehicle’s condition and history. Both documents are instrumental in establishing trust and value in the vehicle market.

Finally, the Emissions Test Certificate is similarly essential as the Texas Odometer Statement in the context of vehicle regulation and environmental compliance. While the Odometer Statement confirms mileage accuracy, the Emissions Test Certificate verifies that the vehicle meets state and federal emissions standards. Both are compulsory documents that affirm the vehicle's adherence to legal and environmental standards, ensuring it is safe and lawful for road use.