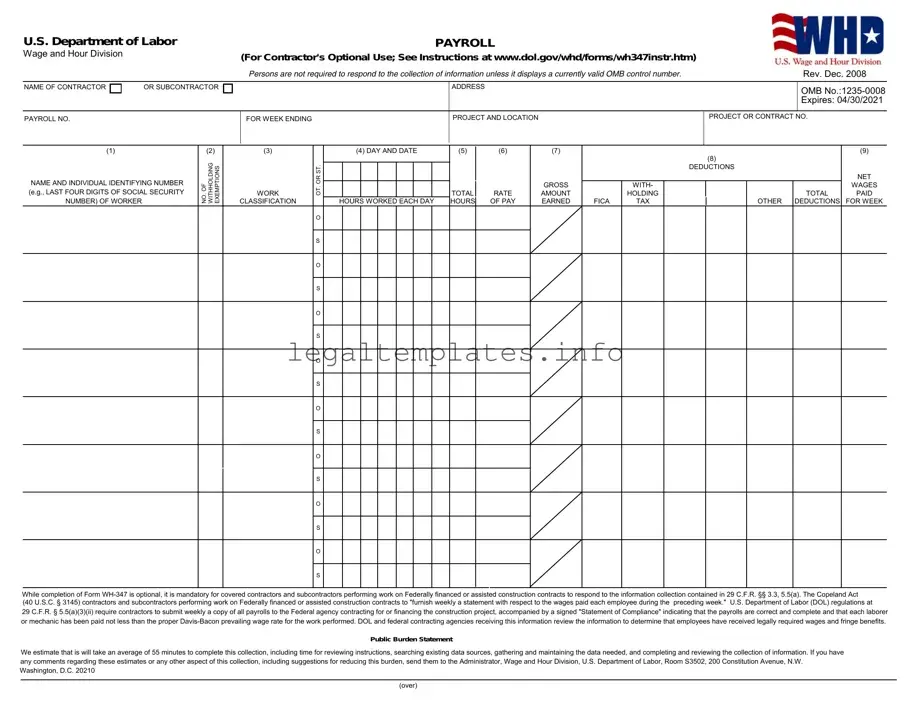

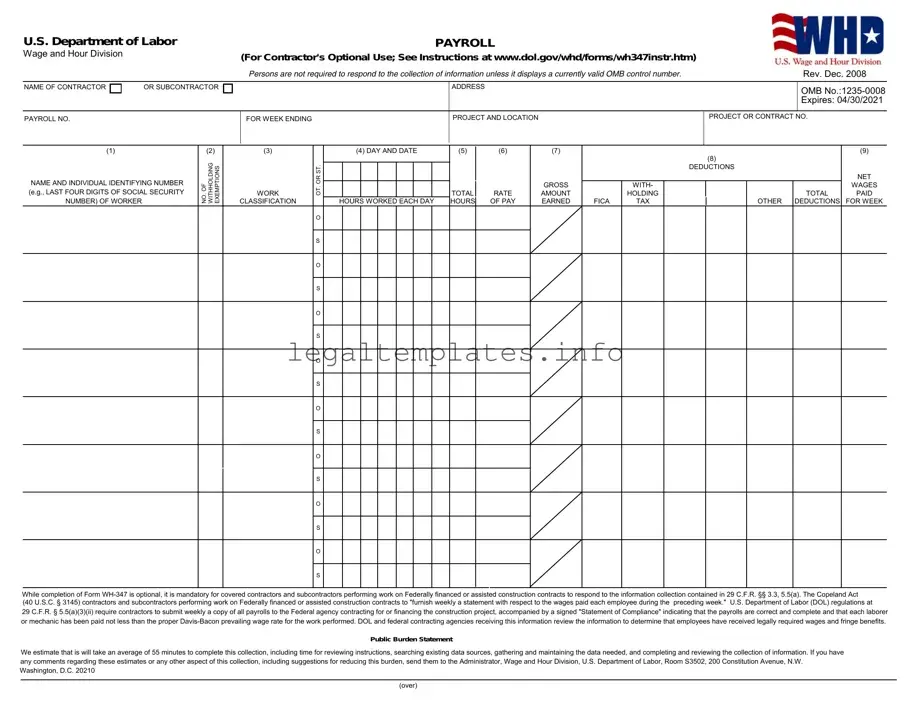

What is the U.S. Department of Labor (DoL) form used for?

This form is utilized for a variety of purposes, including but not limited to, filing for worker’s compensation, reporting workplace injuries, requesting family and medical leave, and ensuring compliance with labor standards. The specific use depends on the type of form you are filling out.

How can I obtain a copy of the DoL form I need?

Copies of DoL forms can be obtained online directly from the U.S. Department of Labor's website. Additionally, they may be available at local offices or by contacting the DoL directly to request a mailed copy.

Are there any fees associated with filing a DoL form?

Most DoL forms can be filed without any fees. However, depending on the specific form or service requested, there might be associated costs. Always check the instructions of the form or the DoL’s website for any fee-related information.

How do I know which DoL form I need to use?

To determine the right DoL form, you should consider the specific requirement or issue you are addressing. The Department of Labor's website offers a search feature and detailed guides for each form, including its purpose and usage. Consulting these resources or seeking advice from a legal professional can also help.

Can I submit DoL forms online?

Many DoL forms can be submitted online via the Department of Labor's website. The availability of online submission varies by form and purpose. Always check the specific form’s instructions for available submission methods.

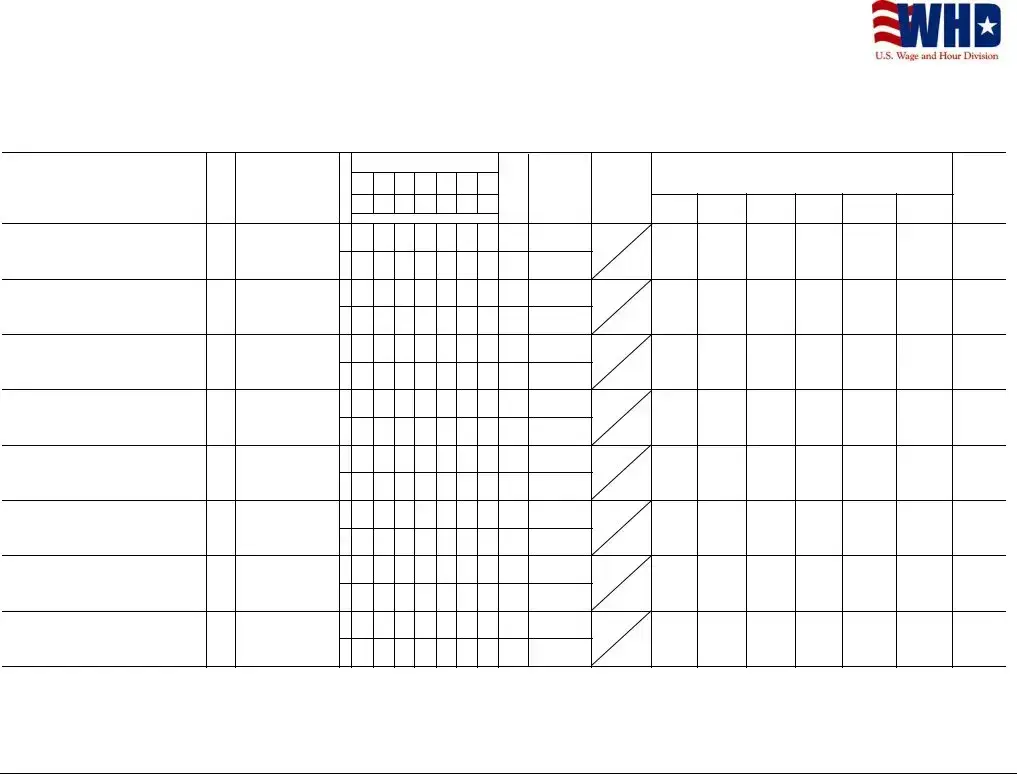

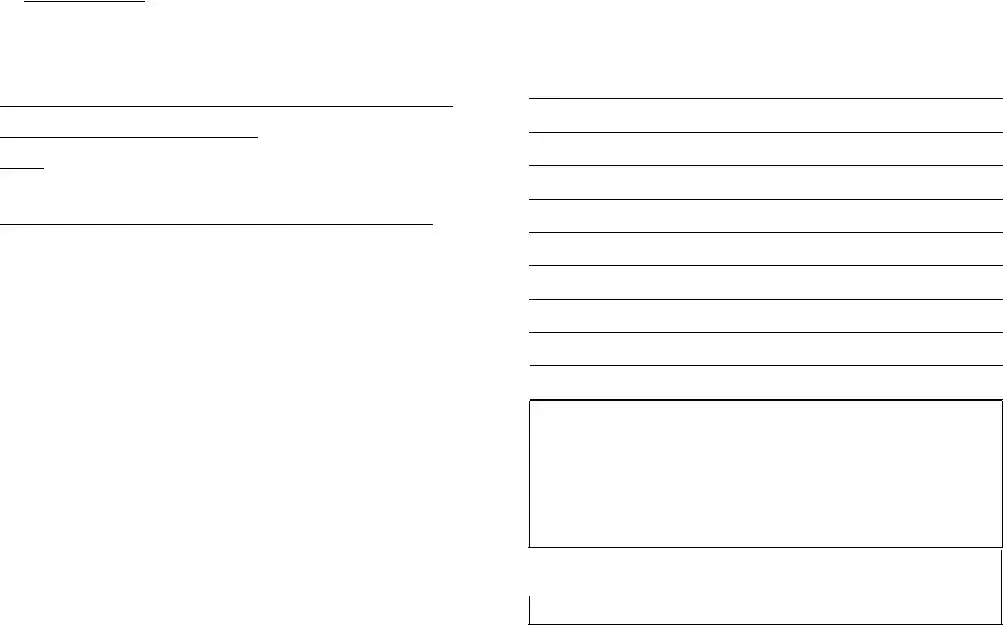

What information do I need to have ready when filling out a DoL form?

Information requirements vary widely by form but generally include personal identification details, employment information, and specifics related to the form’s purpose (e.g., details of a workplace injury for a worker's compensation form). Accurate and thorough information is crucial for a successful submission.

How long does it take to process a DoL form?

Processing times can vary significantly based on the form type, completeness of the application, and current workload of the DoL. While some forms may be processed quickly, others may take several weeks or months. Specific processing times may be listed on the form or the DoL’s website.

Can I get help filling out a DoL form?

Yes, assistance is available for filling out DoL forms. Support can be found through the DoL's website, which offers guidelines and contact information for further help. Additionally, legal professionals can provide guidance and ensure that forms are filled out correctly.

What happens if my form is filled out incorrectly or incompletely?

If a form is submitted with errors or missing information, it may be rejected or returned with a request for correction, potentially delaying your process. It's important to review forms carefully before submission and follow all instructions provided. Contacting the DoL for clarification on any unclear sections can also prevent mistakes.