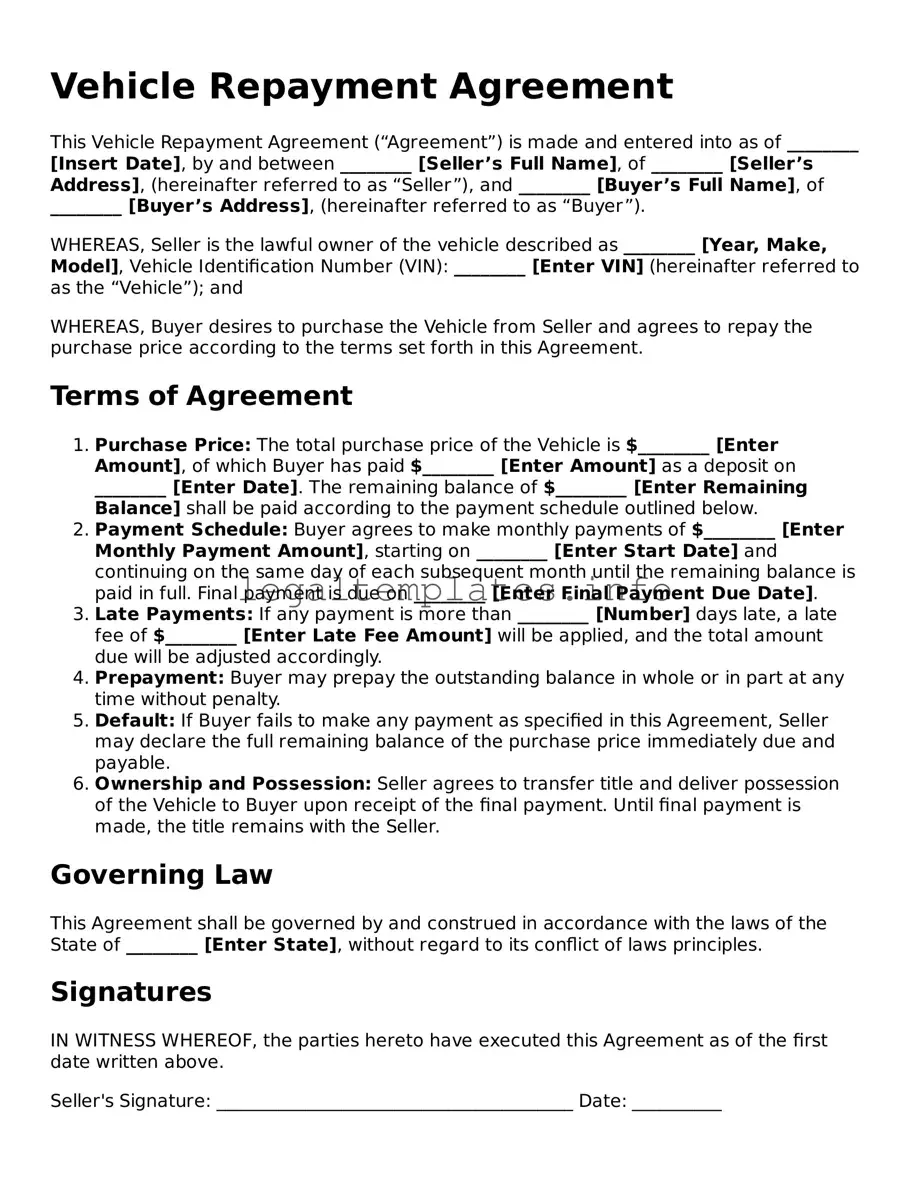

Fillable Vehicle Repayment Agreement Document

A Vehicle Repayment Agreement form is a legal document used when an individual borrows money to purchase a vehicle and agrees to pay back the loan under specified terms and conditions. This agreement outlines the loan amount, repayment schedule, interest rate, and any penalties for late payments, ensuring both the borrower and lender have a clear understanding of their obligations. Interested in securing your vehicle financing? Fill out the Vehicle Repayment Agreement form by clicking the button below.

Access Vehicle Repayment Agreement Online

Fillable Vehicle Repayment Agreement Document

Access Vehicle Repayment Agreement Online

Access Vehicle Repayment Agreement Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Vehicle Repayment Agreement online.