What is a WH-58 form used for?

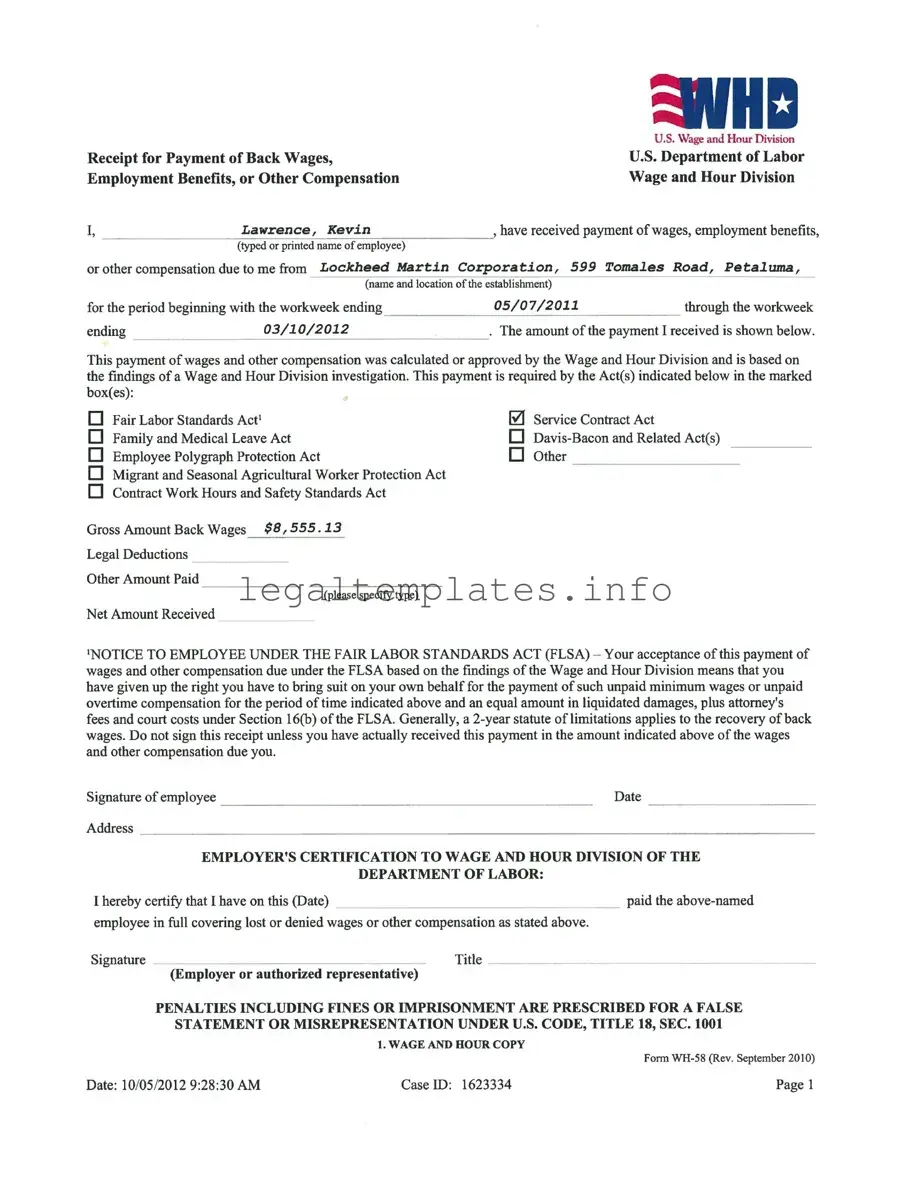

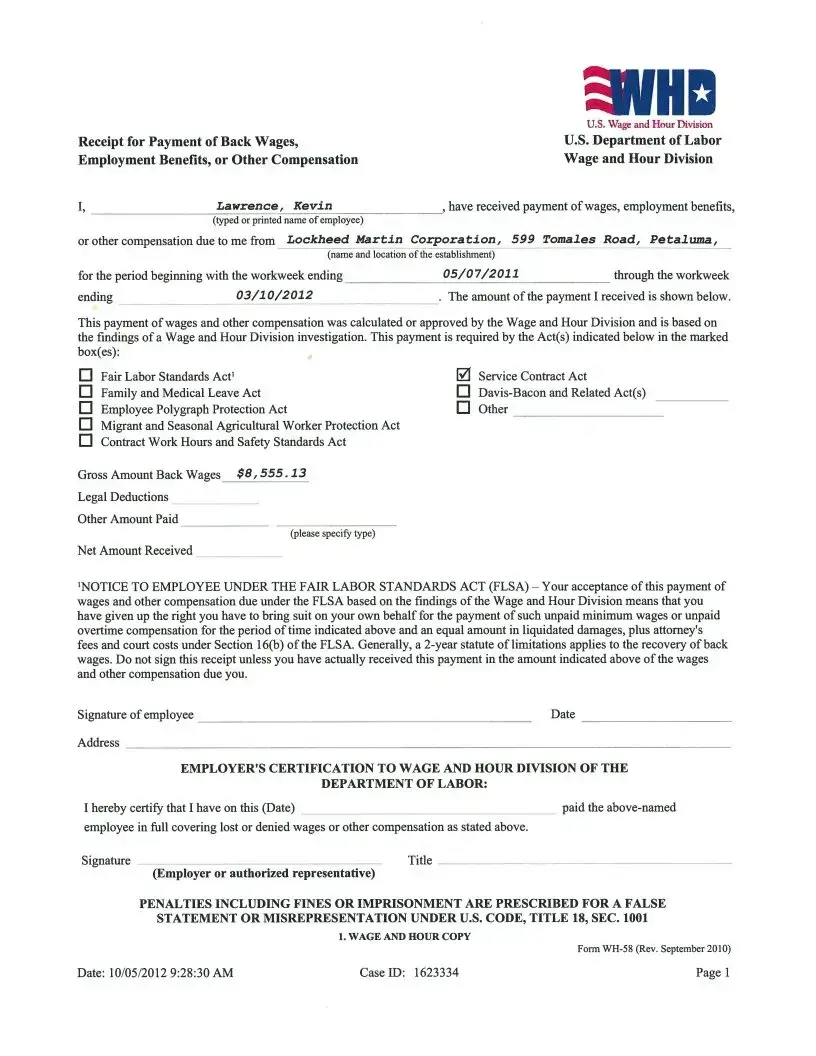

The WH-58 form serves a critical role in the employment sector for the United States Department of Labor’s Wage and Hour Division. It is essentially a receipt. This document is utilized by employees who have received payment of back wages, employment benefits, or other compensation that was due to them, particularly following an investigation by the Wage and Hour Division. The form certifies that an employee has accepted the payment for wages and any additional compensation, indicating a resolution of the issue without the need for further legal action regarding the specified period.

Who needs to fill out the WH-58 form?

Primarily, the WH-58 form is filled out by employees who have received back wages or other owed compensation as a result of an investigation by the Wage and Hour Division. The employee must provide their information, acknowledge the amount received, and understand the implications of accepting this payment. Additionally, an authorized representative from the employer's side is also required to fill a portion of the form. This individual certifies that the payment has been made to the employee, covering lost or denied wages or other compensation as asserted by the form.

What acts does the WH-58 form cover?

This form covers a range of legislative acts that are aimed at protecting employees and ensuring fair labor standards. These include, but are not limited to, the Fair Labor Standards Act (FLSA), Family and Medical Leave Act (FMLA), Employee Polygraph Protection Act, Service Contract Act, Davis-Bacon and Related Acts, Migrant and Seasonal Agricultural Worker Protection Act, and the Contract Work Hours and Safety Standards Act. When employees receive payment due to provisions under these acts, the WH-58 form is utilized to document this transaction.

What are the implications of signing a WH-58 form?

By signing the WH-58 form, an employee acknowledges having received the back wages or other compensation owed to them, as calculated or approved by the Wage and Hour Division. Moreover, under the context of the Fair Labor Standards Act (FLSA), signing this form denotes that the employee is waiving their right to pursue further legal action for additional compensation beyond what is documented for the specified time period. This includes giving up claims for unpaid wages, overtime compensation, liquidated damages, attorney's fees, and court costs relating to the period in question.

Is signing the WH-58 form mandatory?

Signing the WH-58 form is not mandatory; however, it signifies an employee's acceptance of the payment as full compensation for the back wages or benefits owed to them. Employees should only sign the form if they have indeed received the specified payment and agree that it accurately covers the compensation due. If an employee believes the payment to be inaccurate or unjust, they may seek further clarification or pursue additional avenues before signing.

Can the WH-58 form be used for all types of employment disputes?

While the WH-58 form is broadly applicable within the context of wage and hour disputes resolved in favor of employees, it may not be suitable for all types of employment disputes. Its use is primarily centered around cases where an investigation by the Wage and Hour Division has resulted in the determination that back wages, benefits, or other compensation are owed to an employee. Disputes that are outside the scope of the laws mentioned in the document might require different forms or legal processes.

What happens after the WH-58 form is signed and submitted?

Once signed by both the employee and an authorized employer representative, the WH-58 form acts as a formal acknowledgement that the employee has accepted payment of the back wages or other compensation owed. This effectively closes the case related to that specific payment claim under the laws applied, preventing the employee from filing subsequent lawsuits related to the same period and claims covered by the payment. The form thus helps to ensure that both parties have clearly documented the resolution of the wage dispute.

Where can one obtain a WH-58 form?

The WH-58 form can be obtained through the U.S. Department of Labor's Wage and Hour Division. It is available for download on their official website, ensuring easy access for employees and employers alike. Additionally, local offices of the Wage and Hour Division may also provide the form upon request, offering further guidance on its completion and submission.